Take Control of Every Dollar with Hands-On Financial Management

For Families Who Want to Be Hands-On with Their Finances

Unlike automated apps, Bill Nest AI keeps you actively involved in every transaction while providing AI-powered insights to make financial management easier and more effective.

AI Receipt Scanning

Scan receipts to automatically extract itemized purchases and track where every dollar goes. Perfect for grocery shopping and detailed expense tracking.

- Itemized expense tracking

- Auto-categorization

- Receipt image storage

Smart Bill Setup

Photograph your bills and let AI extract payment details, due dates, and amounts to set up automated tracking and reminders.

- Photo-based bill entry

- Payment reminders

- Bill tracking & history

Manual Account Management

Create and manage mock accounts for all your financial institutions with complete control over your data - no bank linking required.

- Multiple account types

- Interest rate tracking

- Loan & debt management

Automated Family Challenges

Our AI automatically creates personalized savings challenges based on your family's spending patterns. Complete challenges to earn points and watch your nest grow visually.

- AI-generated challenges

- Points-based rewards

- Visual nest growth

Customizable Dashboard

Personalize your financial overview with widgets including spending forecasts, financial health scores, and AI-powered insights.

- Free & pro widgets

- Custom time periods

- Quick actions

Income & Allowance Tracking

Track multiple income sources and set up child allowance accounts with age-appropriate interfaces and parental controls.

- Multiple income sources

- Child allowance accounts

- Paycheck reminders

Your Data, Your Control

We believe in keeping you actively involved in your finances. That's why we never link to your bank accounts - you maintain complete control over your financial data while still getting powerful AI insights.

Smart Analysis Without Compromising Your Privacy

Our AI analyzes your manually tracked expenses to provide personalized insights, debt management plans, and spending recommendations - all while keeping your data under your control.

Daily AI Insights

Get personalized daily insights about your spending patterns and financial health

Debt & Financial Plans

AI-generated plans to help you tackle debt and achieve your financial goals

AI Financial Chat

Chat with AI about your finances for personalized advice and insights

Financial Health Score

Track your overall financial wellness with AI-calculated health metrics

Teaching Financial Responsibility to Every Family Member

Create a connected financial ecosystem where parents maintain oversight while children learn money management through age-appropriate interfaces and allowance accounts.

Family Owner Control

Complete oversight with the ability to manage all accounts, set permissions, and monitor family member activities while teaching financial responsibility.

- Full account oversight

- Set member permissions

- Monitor all transactions

- Manage allowances

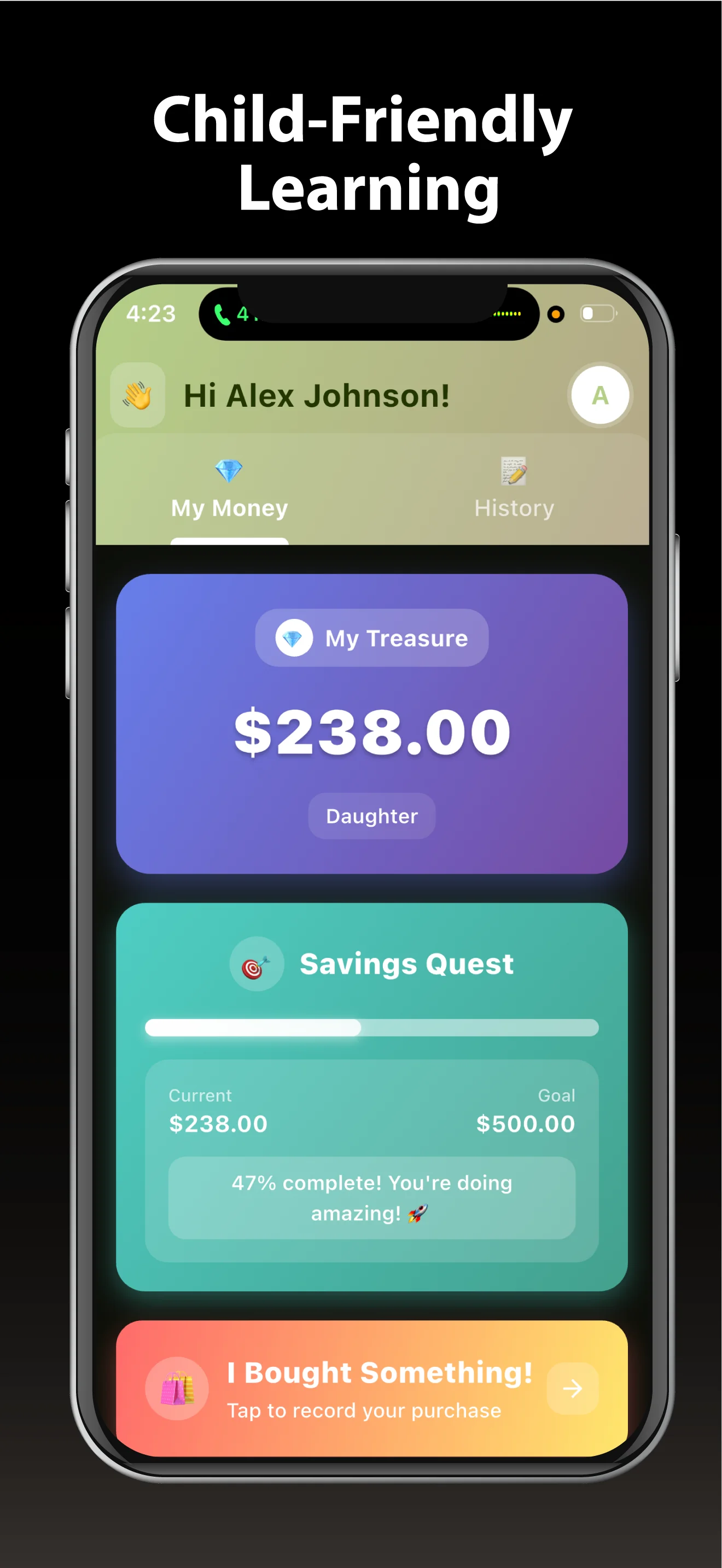

Child-Friendly Learning

Age-appropriate interfaces with educational elements that teach financial responsibility through hands-on allowance management and spending tracking.

- Simplified interface

- Allowance accounts

- Purchase history

Automated Family Challenges

AI creates personalized challenges based on your spending patterns. Complete them to earn points and watch your family's "Bill Nest" grow visually - no manual setup required.

- AI-generated challenges

- Automated tracking

- Points & visual rewards

- Family engagement

Choose Your Plan

Start with our free plan and upgrade when you're ready for advanced features and unlimited family members.

Free

Perfect for getting started

- Up to 2 family members

- Basic receipt scanning (limited)

- Bill tracking & reminders

- Mock account management

- Free dashboard widgets

- Basic push notifications

- No allowance accounts

- No AI chat or pro widgets

Monthly Pro

Flexible monthly billing

- Unlimited family members

- Unlimited receipt scanning

- Child allowance accounts

- AI financial chat

- All pro dashboard widgets

- Financial health scoring

- Advanced AI insights

Yearly Pro

Best value for families

- Unlimited family members

- Unlimited receipt scanning

- Child allowance accounts

- AI financial chat

- All pro dashboard widgets

- Financial health scoring

- Advanced AI insights

Ready to Take Control of Your Family's Financial Future?

Start your hands-on financial management journey today. Track every expense, build family savings challenges, and keep your data under your control.

Frequently Asked Questions

Everything you need to know about Bill Nest AI and how it helps families manage finances hands-on.

Still have questions?

Contact Support